It is a competitive world - no matter what stage you are at in your career. It is always best to step back periodically and assess your career progression and goals. Are you happy in your current job? Are you learning and growing professionally? Do you enjoy working with your teammates? Is your compensation fair?

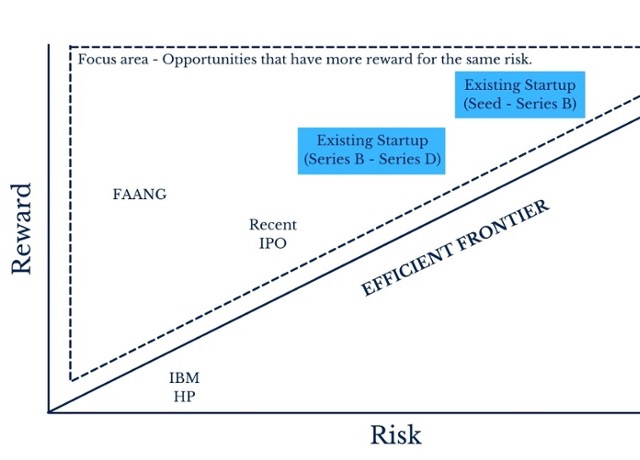

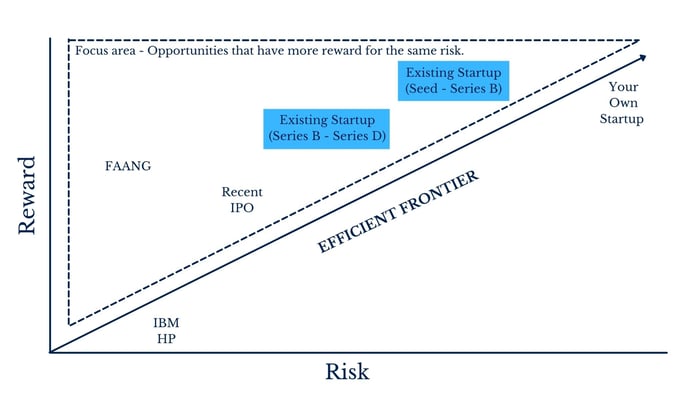

As you evaluate your current career situation, it is necessary to evaluate your choices. It is important to have a framework to refer to. Here is one such framework adapted from the classic Risk-Reward model. We call it the “Efficient Frontier of Technology Career Choices”.

The Efficient Frontier of Technology Career Choices

The graph above is a simple risk-reward spectrum. As you can see, roles at different stage companies all have their own ratio of risk to reward and there are a number of factors that determine which side of the Efficient Frontier line it is on.

On the bottom left are the low risk options that also have lower rewards - a job at a company that has been around for a long time, and is not growing rapidly. HP and IBM come to mind (however, it has been pointed out, HP and IBM may be a higher risk than you might think - what with layoffs and the dreaded repeated “re-orgs”). In our opinion, there are a few examples of opportunities in the current landscape where the potential rewards outweigh the risk:

1. FAANG and other industry giants - Before the last decade, it was hard to get wealthy working at large companies. However, the combination of the war for talent as well as the stock and cash compensation handed out by these companies, has made this very possible. Another added advantage of being in these companies is that you may well meet the potential co-founders of your future startup.

2. Companies that have recently gone public - It is reasonably hard for a company to go public in a traditional way - they need very good growth rates and predictable revenue. Stocks of these companies have “popped” after their IPO as well, so they are a good place to be a part of a growth story and be reasonably secure. Companies like Datadog, Snowflake and Twilio come to mind, along with many others.

3. However, the TRUE sweet spot in this area above the EF line is an existing startup that falls into one of two categories, a company at the Seed - Series B stage or a company at the Series B - Series D Stage. When looking for a startup, it can be beneficial to look for one that has raised in the last six months from a Top 20 investor (Sequoia, Accel, Benchmark, A16Z, Battery, Bessemer and so on). The amount for a Seed-Series B range from $5 million - $50 million, and for later stage companies, the rounds are typically $75 million and above. The signals from such a round for a late stage round are all quite positive:

- The company likely has a very high growth rate (100%+ which is the requirement for such rounds in this day and age)

- Software companies in this area will be using this money mainly to hire the best talent across the board

- Could be an IPO candidate in 2-4 years and may currently be a Unicorn

4. At every point in your career, you should also evaluate whether or not you want to either start your own company or join a very early stage startup. There are tremendous risks in doing that of course. But the rewards are many fold - not only financially, but in terms of career growth and impact. It should be noted that starting your own company is a major leap of faith in your ability to raise money, build a team, build a product, achieve product-market fit and scale. It is not for everyone. And it is not sexy for the first few years. But it is, and shall remain, the foundation for the American Dream.

No matter what opportunity you choose, the single most important rule when choosing is this - you must optimize for points ABOVE the line - i.e. larger rewards for the same risk!